There is no question that the accelerating developments of financial technology applications — popularly known as “fintech” — are starting to impact the banking sector visibly.

A significant disruption to the financial landscape is likely to come from the big tech firms, who will use their enormous customer bases and deep pockets to offer financial products based on big data and artificial intelligence.”

— Christine Lagarde

IMF Managing Director

- Market dimensions – In 2014 and 2015, venture capital investments into fintech startups worldwide averaged about $12 billion annually. In 2020, fintechs attracted $42 billion in venture capital, second only to 2018, when Ant Financial raised $14 billion in the world’s largest private financing round ever.

- Europe challenger banks – The arrival of European challenger banks, including London-based startups Monzo and Revolut, plus Berlin-based N26, represents the first wave of the globalization of fintech. Monzo has partnered with Ohio-based Sutton Bank. Revolut has submitted its draft application for a U.S. banking license. N26 claims to have 5 million customers worldwide, and 250,000 in the U.S. Monzo has 4 million customers worldwide with no U.S. figures disclosed. In contrast, Revolut claims to have 10 million, with also no U.S. data supplied. N26 Co-founder & CEO Valentin Stalf had a particularly brutal assessment of U.S. banks: “We’ve looked at the products in the U.S., and we figured out that most banking products in the U.S. are even worse than in Europe.” Them’s fighting words!

We’ve looked at the products in the U.S. and we figured out that most banking products in the U.S. are even worse than in Europe.”

— Valentin Stalf

N26 Co-founder & CEO

Challenger banks offer the ability to open an account, order a debit card and get your checking account in just a few minutes. The Europeans, however, were beaten to the punch by Apple, Chime, and T-Mobile:

- Apple Card – Apple Card offers all of Apple’s trademark user experience niceties, including an all-white titanium credit card devoid of numbers and with minimal branding. Apple Card provides 1% cashback on physical card purchases, 2% on Apple Pay purchases, and 3% on purchases from Apple, with cashback credited every day. And, of course, there are no late fees, no annual fees, no international or over-limit fees. The sign-up process through the iPhone Wallet app was effortless and it took less than five minutes to be approved. Our Apple Card arrived in about five days, handsomely packaged in a white cardboard folder. All in all, a stellar customer experience.

- Chime – U.S. fintech challenger Chime is perhaps the best known challenger bank. In December 2019, Chime raised $500 million, valuing the startup at $5.8 billion. Chime one-upped T-Mobile MONEY taking just five minutes to sign up for a checking account. Chime offers 0.5% interest on its savings account and a Credit Builder card for people looking to improve their credit. Chime insures accounts up to the standard maximum deposit insurance amount of $250,000 through its bank partners, The Bancorp Bank or Stride Bank, N.A., members FDIC. Chime has grown unusually fast for a company with a minimal profile. The startup claims to have skyrocketed from 1 million accounts in 2018 to nearly 8 million as of February 2020. Most of that growth came from literally giving money away and viral marketing, with Chime paying customers $50 for signing up and $50 for each referral.

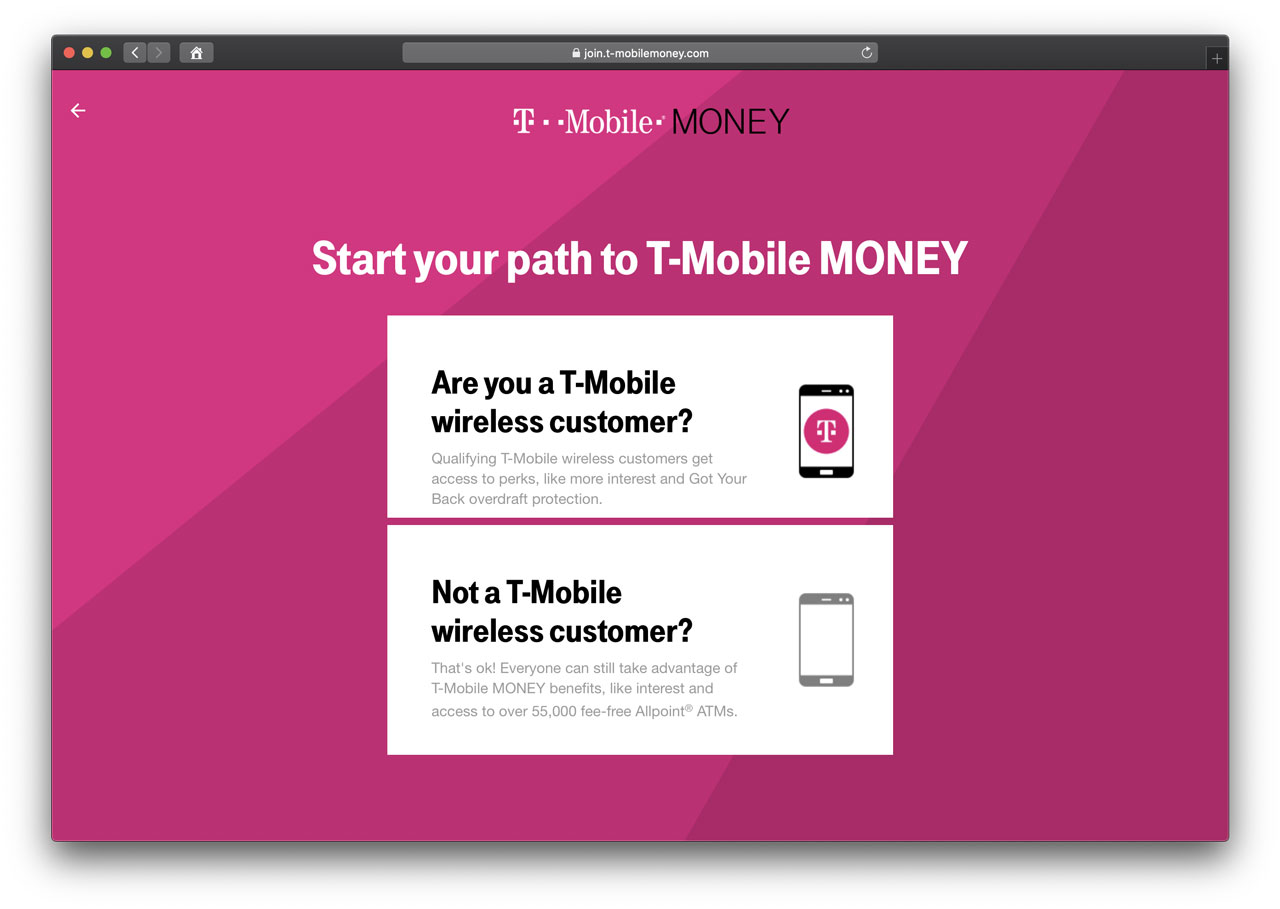

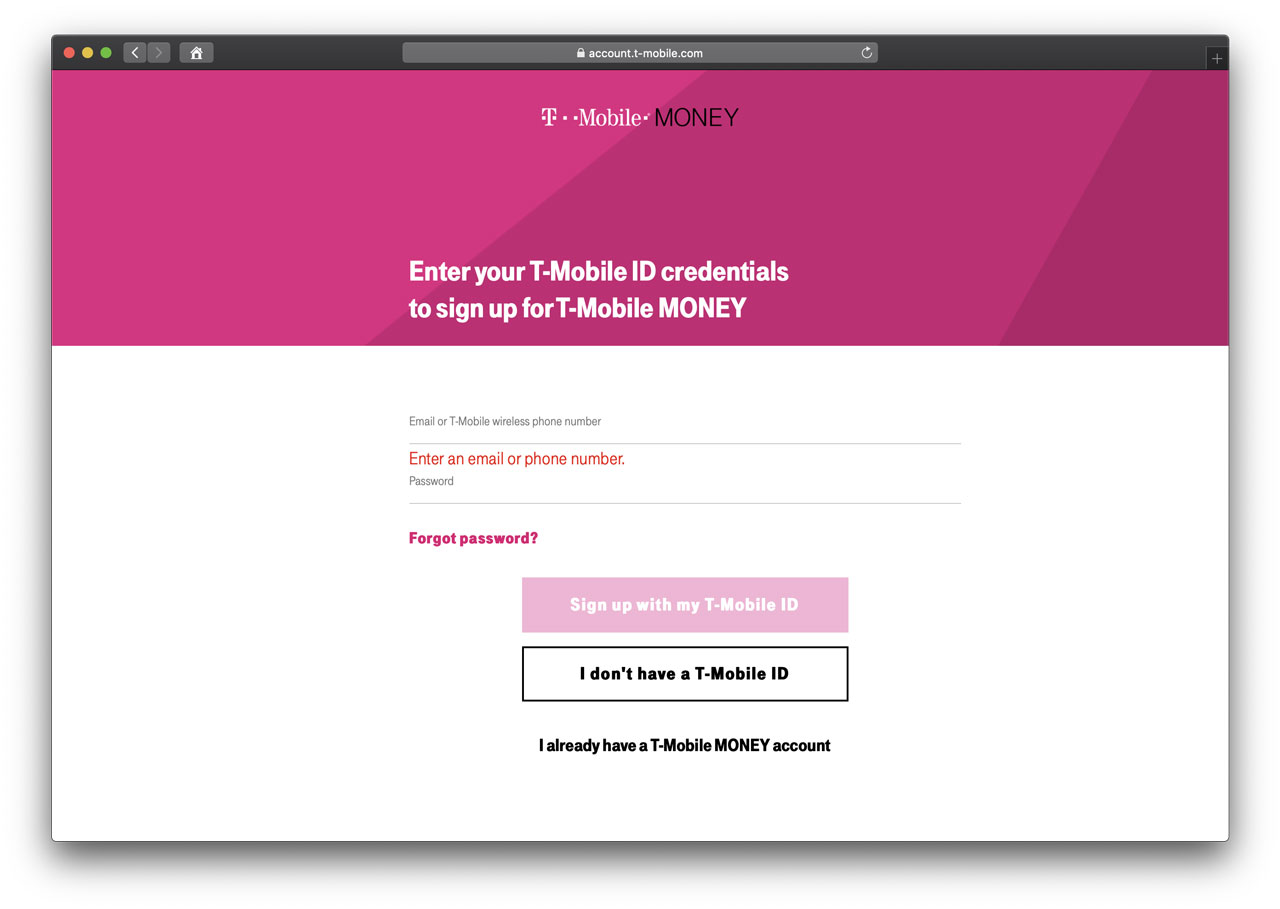

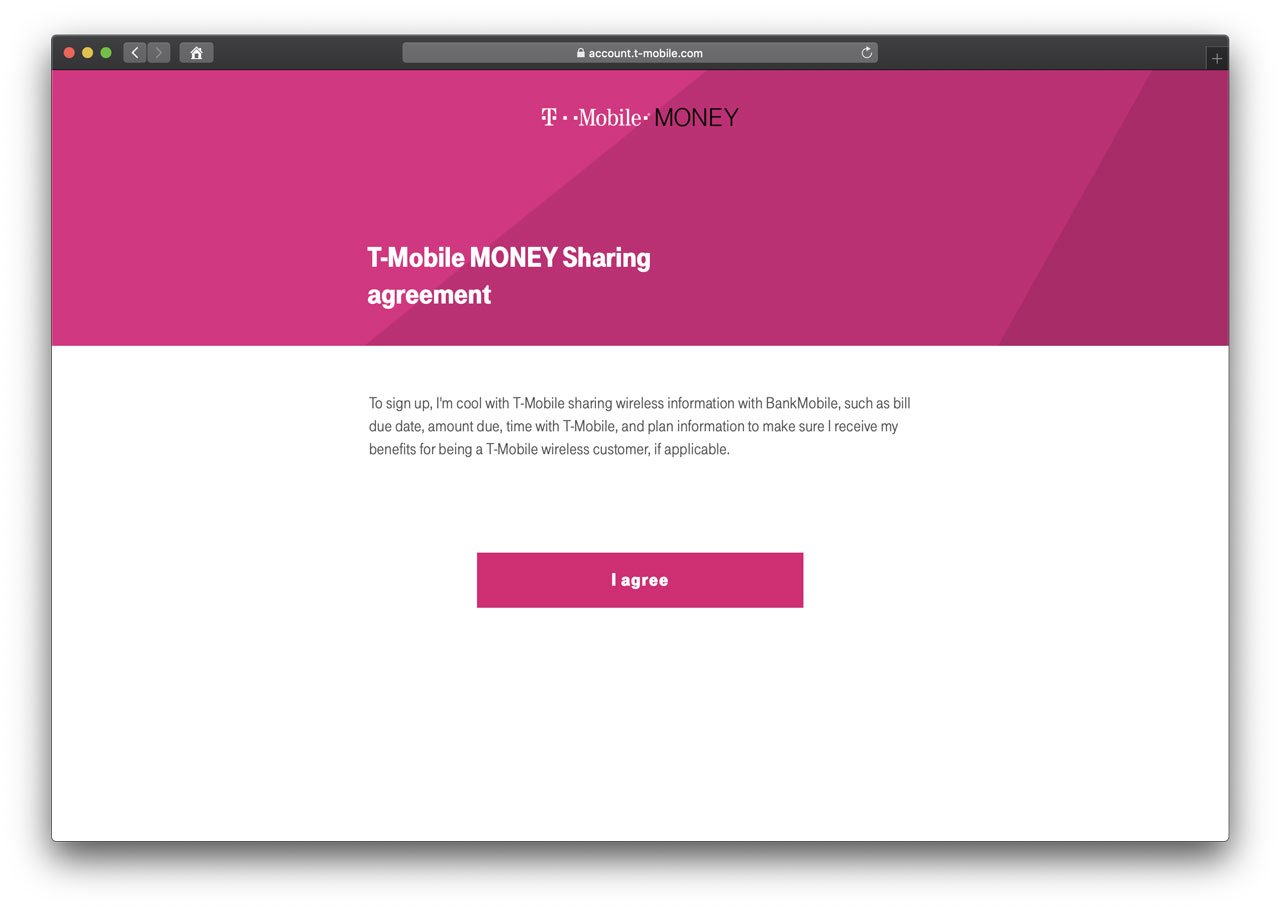

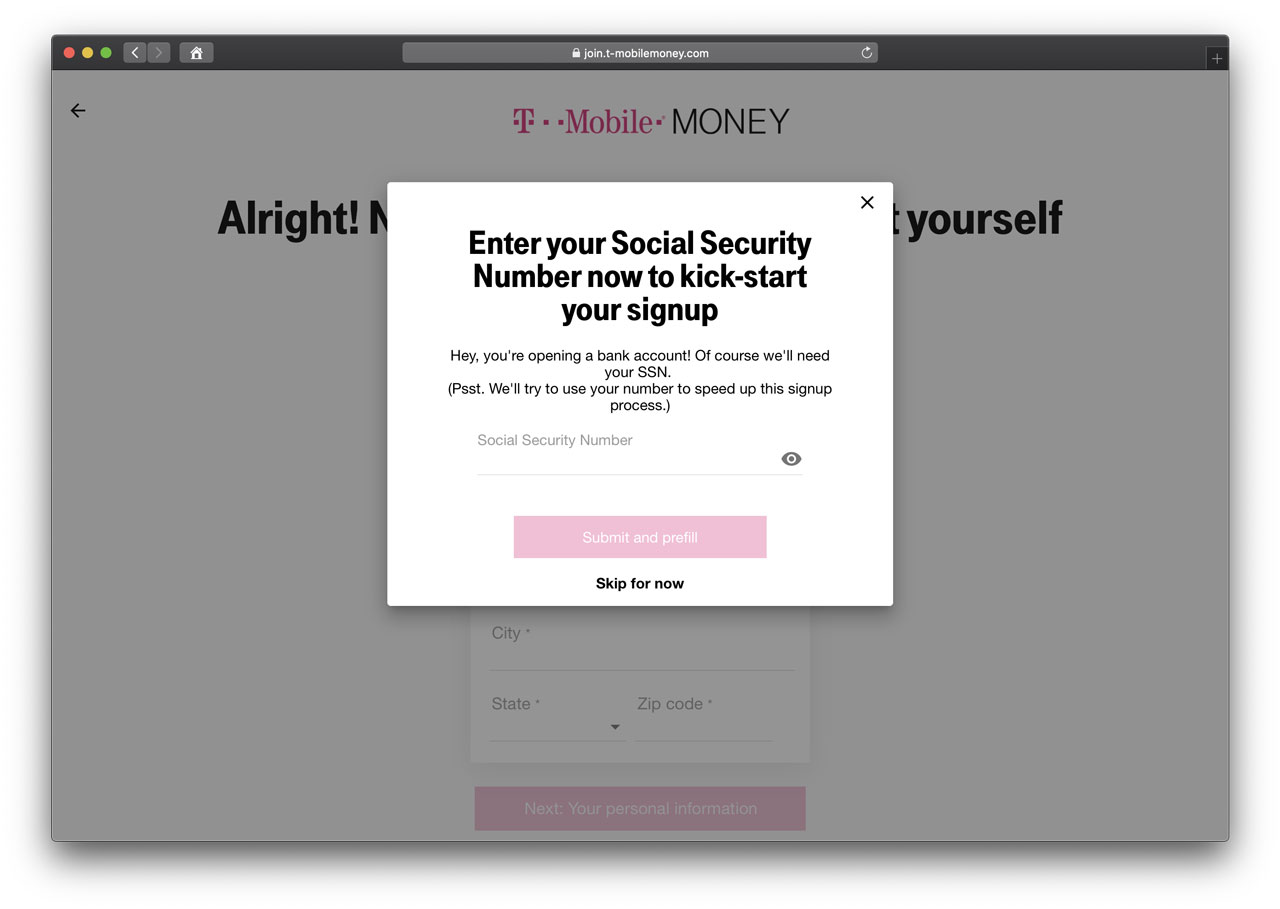

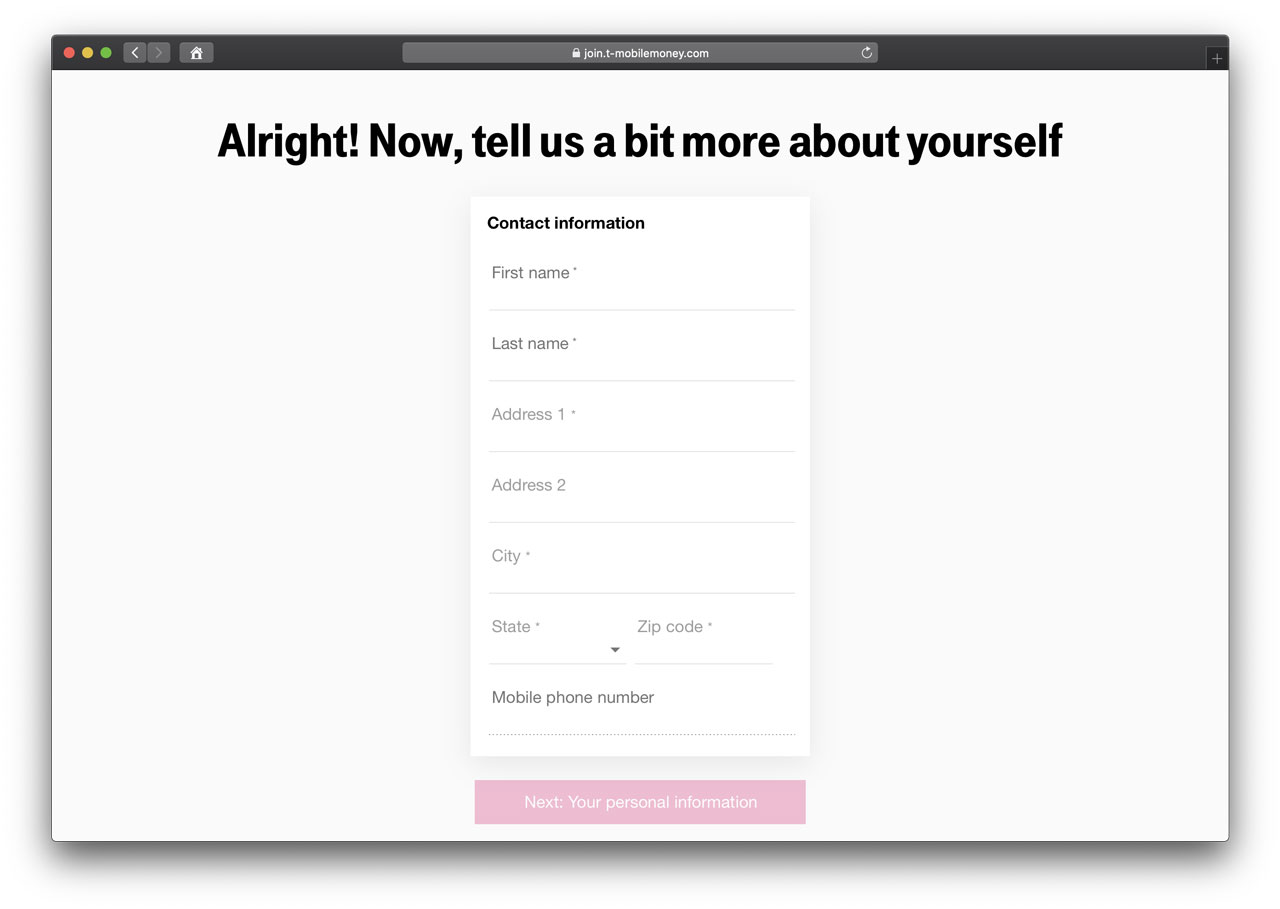

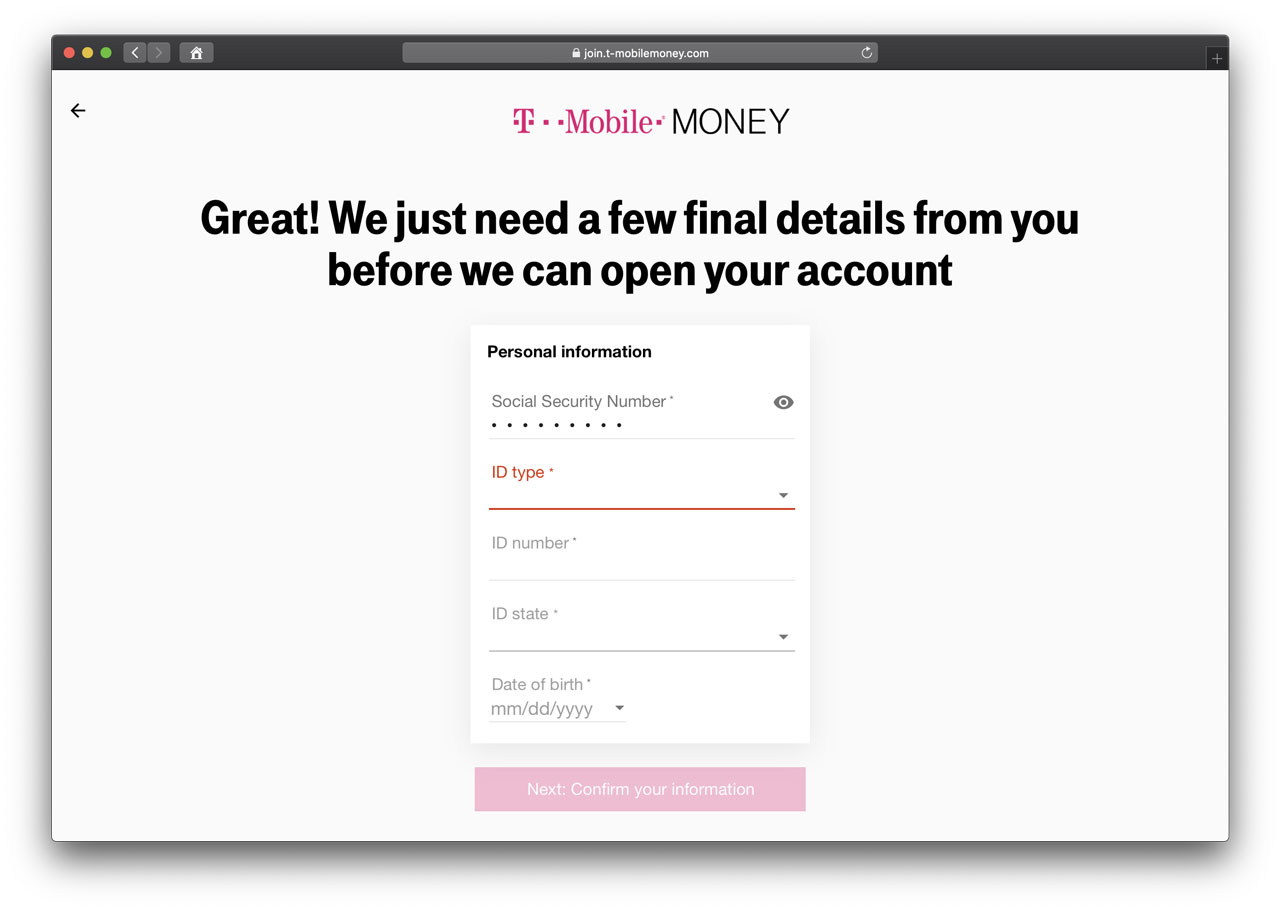

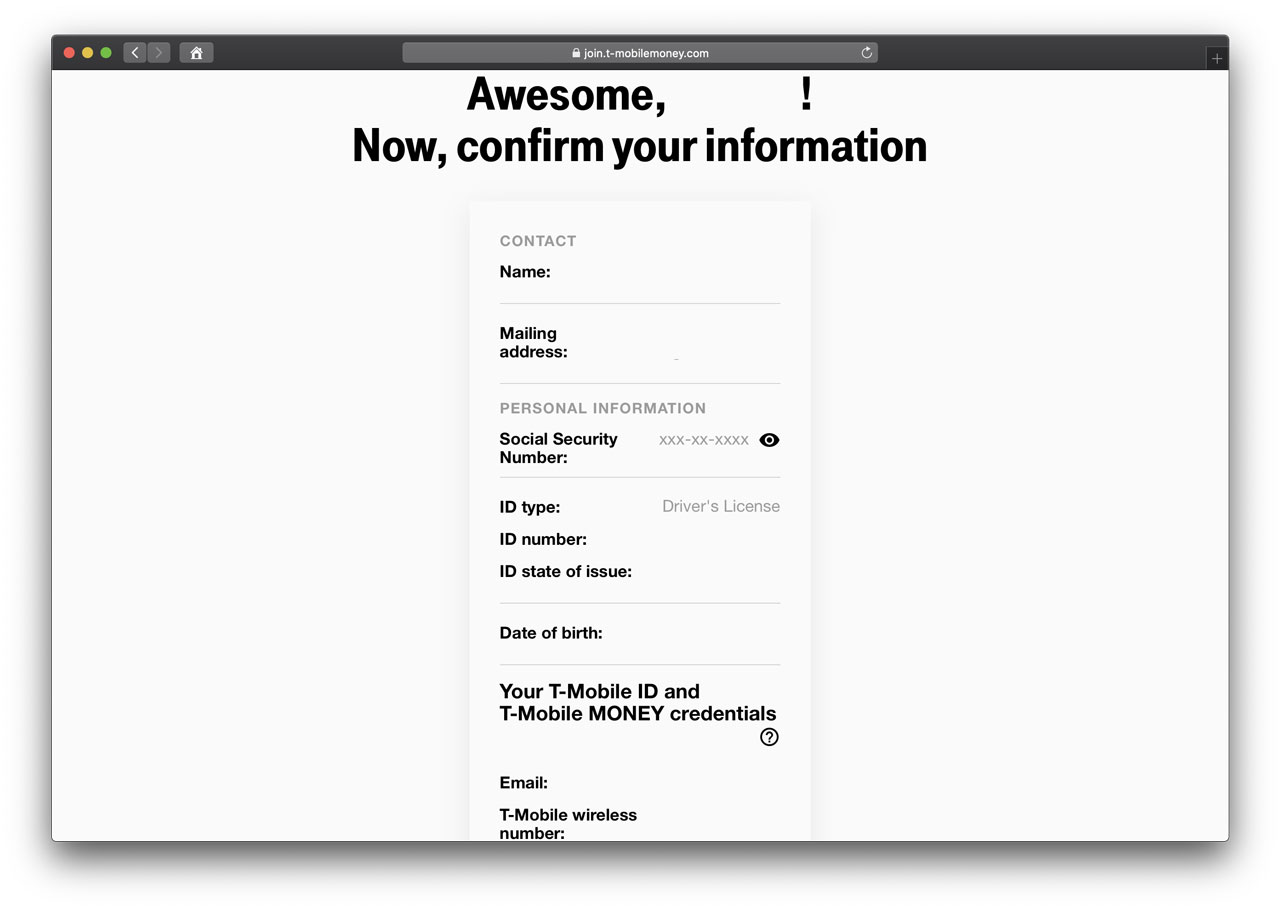

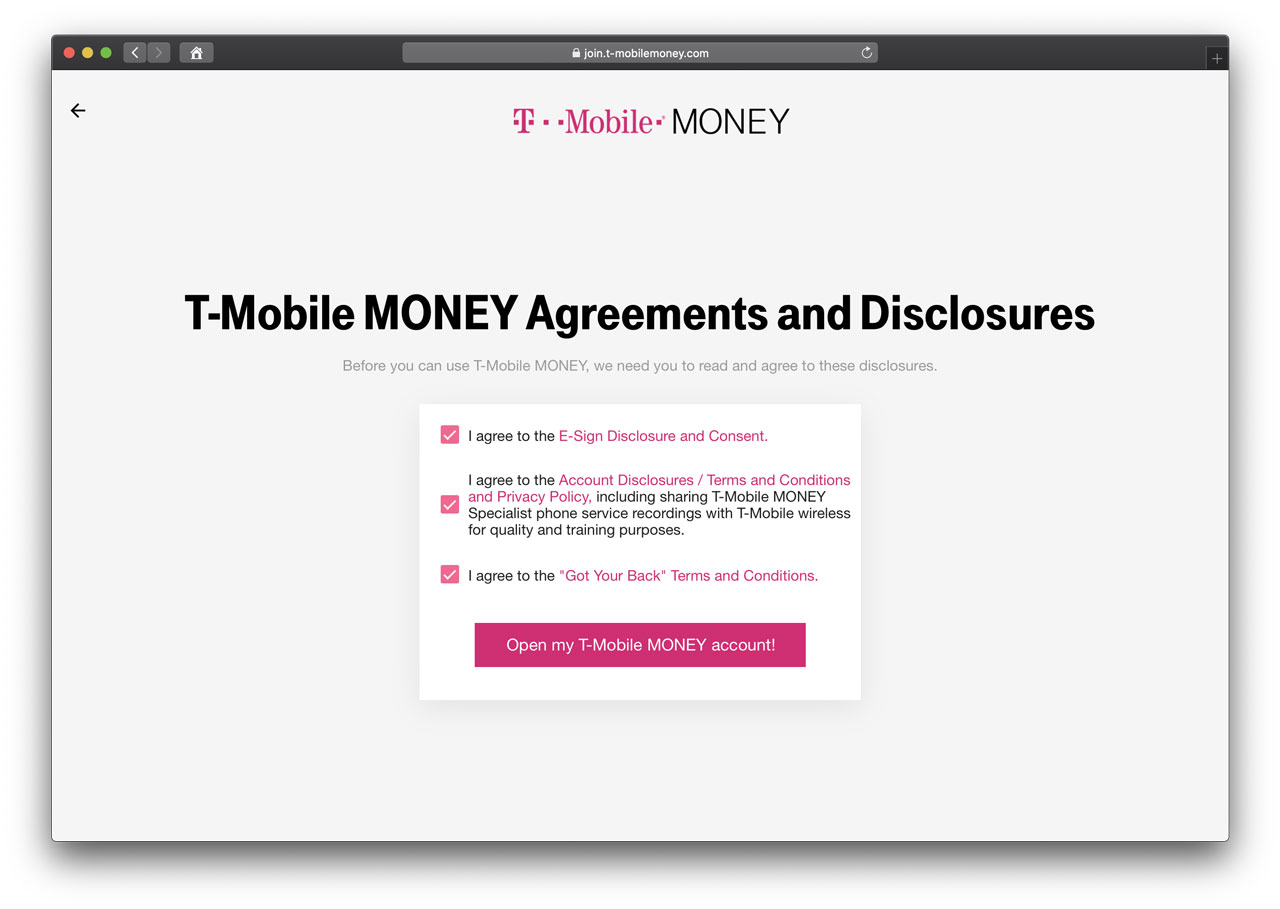

- T-Mobile MONEY – T-Mobile launched T-Mobile MONEY in April 2019 in concert with New Haven, CT-based BankMobile, a division of Customers Bank. T-Mobile MONEY offers a customer experience that U.S. banks are going to have to emulate quickly. A gallery at the end of this story shows the entire 10-minute T-Mobile MONEY sign-up process. Study it. Emulate it, legacy banks, and savings and loans. The T-Mobile MONEY debit card also arrived in about five days.

It’s quite appropriate that the theme of the June 2019 Group of 20 meeting where Lagarde spoke was “Our Future in the Digital Age.” Banking giants, and startups, you are on notice. 🤯

T-Mobile MONEY Account Sign-up Steps

Click on any image below to enlarge it.